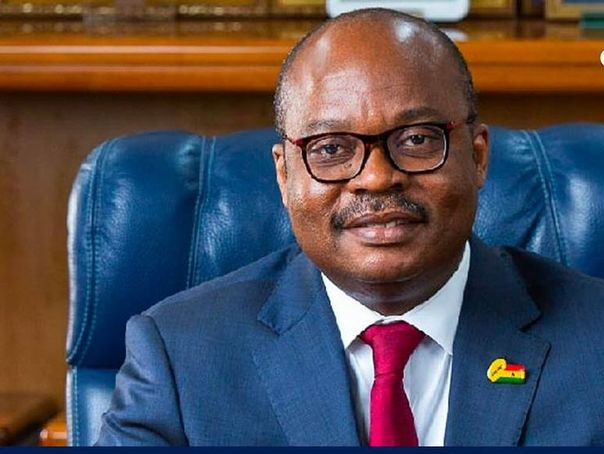

Speaking at the Governor’s Day organized by the Chartered Institute of Bankers, Dr Addison commended the central bank’s role in preventing the economy from succumbing to the pressures of the crisis.

“It is important to remind ourselves, as players in the global economy, that the crisis that hit the Ghanaian economy in 2022 was like what pertained in many other frontier and emerging market economies, including Egypt, Argentina, Turkey, Kenya, Sri Lanka, and Pakistan, just to mention a few. These countries, except for Sri Lanka, had built policy buffers and the resilience of their key institutions provided the needed anchor to hold their economies until reform packages were introduced.”

Dr Addison added that in the case of Ghana, the strong policy buffers built over time, allowed the bank to step in to support the economy until the IMF programme was concluded.

“The Bank played a critical role to support the economy during the crisis period with distinction. It is very clear the bank’s role in supporting the economy through this crisis has not been fully understood and in some cases deliberately misinterpreted. The Bank came under severe attack across the media space, culminating in an organised demonstration against the institution.

“Ladies and Gentlemen, central banks all over the world have had to re-evaluate their mandate since the global financial crisis of 2007/2008 and have supported fiscal policy to play a countercyclical role in stabilizing economies.

“Consequently, central banking has never been the same. Before the financial crisis, the quintessential task of central banks was straightforward, keeping inflation within a tight range through the control of short-term

interest rates. In a world of polycrisis, central banks have found themselves broadening monetary policy formulation beyond interest rates to include the deployment of balance sheets in a variety of unconventional monetary policies.”