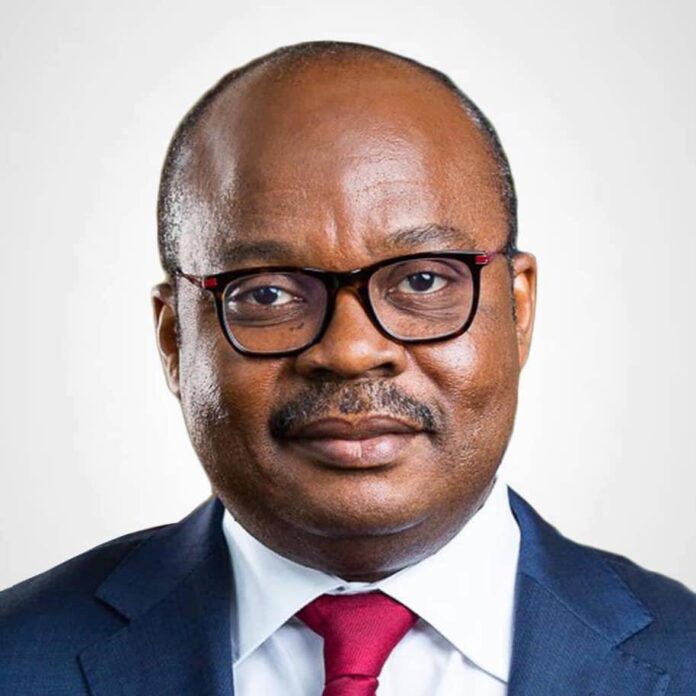

The Governor of the Bank of Ghana (BoG), Dr Ernest Addison, has said that the Bank will continue to maintain a tight monetary policy stance until it is confident that inflation is firmly anchored and aligned with the disinflation path agreed in the ongoing programme with the International Monetary Fund (IMF).

Governor Addison indicated that Ghana is seeing relative stability in the exchange rate, depreciating by only 2.5 percent between February till date.

“It is therefore very important to sustain this strong performance and consolidate the gains we are seeing,” he said in a statement on Monday, October 9.

He further thanked the entire IMF team for what he describes as the constructive engagement during the past two weeks on all issues bordering on fiscal policy, monetary policy, and structural reforms.

Indeed, the Governor said, it has been a very comprehensive and collaborative work between the Government’s side and the IMF.

“We have all established that the very decisive measures put in place by the Government and the Bank of Ghana have started yielding results, signaling a faster than expected turnaround which needs to be sustained as we reset the economy,” Dr Addison said.

More specifically, he added “Non-Food inflation has dropped significantly by 19 percentage points, Food inflation has also by some 8 percent, Core inflation, which measures underlying inflation, is also decelerating at a fast pace, From the beginning of the year to date, the Bank of Ghana has built reserves of about US$650 million instead of a programmed drawdown of US$98 million. And this has been boosted by the innovative Gold for Reserves programme.

“And, as a result, we have seen relative stability in the exchange rate, depreciating by only 2.5 percent between February till date. It is therefore very important to sustain this strong performance and consolidate the gains we are seeing. Looking ahead, the Bank of Ghana will continue to maintain a tight monetary policy stance until it is confident that inflation is firmly anchored and aligned with the disinflation path agreed in the program.

“There would be challenges and difficulties as we work towards sustaining these gains but we remained focused and committed to the reforms and prudent policies to ensure the full benefits of this program are achieved.”

Last week, the Chief of Mission of the Fund, Stéphane Roudet, confirmed that Ghana’s economic recovery was turning out to exceed expectations.

“What we are seeing in terms of growth dynamics is better than what we were anticipating,” Mr Roudet said on Friday, October 6.

“I think this is very good news,” he added.

The IMF Chief of Mission was speaking at a joint press conference held at the Ministry of Finance with the sector minister, Kenneth Nana Yaw Ofori-Atta, in attendance.

The press conference follows recent meetings with the IMF Mission over the $3-billion external credit facility (ECF) Ghana is currently undergoing with the Fund.

Mr Roudet was happy a lot of the indicators are improving and showing favourable signs.

“Inflation is coming down, international reserves of the central bank are going up which is also very important to boost confidence.”

He added that the economy is generally experiencing a turnaround.

“So, clearly there is a turnaround, there is an improvement and signs of macroeconomic stability are now emerging.”

He, however, cautioned the authorities not to rest on their oars but to strive to improve the situation.

Finance Minister Ofori-Atta expressed confidence that the country is on the right path to economic recover.

“Already, the economy is responding positively, strongly to the news of the GoG and the IMF reaching an LSA for the first review and we are eager to leverage on this.”